Contraceptive R&D

General overview of R&D

Research and development (R&D) refers to the process of designing and testing new products, technologies, and services. For new medicines and devices it’s a long, high risk, time-consuming and expensive process. Product developers embarking on R&D depend on many years of basic research to generate ideas for new products. They then create potential new products (research) and test them on patients (clinical development) before launching them into the market where they can be accessed by patients. An R&D department in a company will continue to do some post-marketing research on the product after launch but the primary phase of R&D ends with product launch.

How long? Clinical testing and approval alone takes about 10.5 years on average. Many additional years are needed for the steps to identify and produce a new molecule or device, and conduct the basic science needed before molecules and devices are even identified.

How risky? Only 13% of the drugs that enter clinical testing reach the market. So all the money invested in expensive discovery and testing is lost for most drugs that start the process.

How expensive? Estimates vary but the consensus appears to be between $1-2 billion to get a successful product given the high failure rates. Yes, that was billion!

Steps in the R&D process

The R&D process includes several stages, each of which is designed to move a concept from initial ideation to final product development and commercialization.

For more details on each step, click on the process diagram.

Even before organizations begin R&D, basic scientific research is necessary to surface concepts for new drugs or new devices. This might involve better understanding reproductive biology. It might involve identifying potential places in the biological pathways where contraception might work – we call this “target identification”. The target could be a protein, receptor, enzyme, or other molecule that plays a role in a disease or condition. Basic science might also involve discovering new materials that might act as contraceptives e.g. to inhibit sperm. Or it could involve new devices that might prevent pregnancy or which could be used to carry active ingredients to the site of action e.g. as hormonal IUDs do. This stage of research is mostly done by academic scientists in University or hospital labs but sometimes as part of the discovery stage in R&D organizations.

Once basic science identifies areas of interest for product development, product developers typically test that science in a process called “target validation” to make sure that the science is sufficiently robust to merit more investment. Scientists then create potential drug candidates (lead identification) that act on the target or develop prototypes (in the case of devices). These leads and prototypes are optimized to create candidate drugs that then go into testing.

The pre-clinical phase of testing ensures that potential products don’t have unexpected toxicity when tested in animals and behave as anticipated in modifying disease. Scientists also use this phase to test things like the concentration of the drug needed in humans. These studies support the application of the sponsor company or organization to the FDA (or other regulatory agency outside the USA) to conduct human studies. The regulatory agency has to give approval for the human testing protocol. This testing protocol has a series of stages during which human safety and efficacy (and, for drugs, the right drug concentration) is tested. At the end of phase 3, the results of the trials are shared with the regulatory agency in something called a New Drug Application (or equivalent for biological drugs and devices). While drugs and devices are in testing, manufacturers have to begin committing resources to the final manufacture of the product, before knowing if testing will prove efficacy and safety. Manufacturing investments (which are also on top of the R&D $1-2 billion investment) can also run into the billions with substantial fractions at risk.

In this phase the appropriate regulatory agency carefully reviews the New Drug Application/equivalent. The application can run to 100,000 pages! The sponsor must conduct the appropriate non-clinical testing and prove safety and efficacy in a suitable set of patients. There needs to be a robust manufacturing process for the drug, biological or device. If successful, the regulator will issue an approval notice.

During this phase companies will typically begin to prepare for launch including pricing and reimbursement negotiations, as well as continuing manufacturing ramp ups.

In this phase access to the new product expands to different countries. Regulatory agencies in additional countries will also review new products. The marketing company also has to comply with annual filing requirements and track serious adverse events to ensure that rare side effects that weren’t detected during regular sized trials are picked up when they reach broader populations. Regulatory agencies may during an application review determine that the new product can be approved for sale but that the company needs to conduct post-marketing – or phase IV trials to answer additional safety or efficacy questions.

Contraceptive R&D funding landscape

Total global funding for contraceptive R&D was approximately $134 million in 2021 as reported by G-Finder. Given the $1-2 billion cost to develop new drugs, this figure is woefully inadequate. Contraception has relatively low public, and particularly low private, sector funding compared with other medical areas. For instance, contraception has only a tiny number of active clinical trials of new products relative to other therapeutic areas. In 2019, contraception had 20-25 active clinical trials, cancer had 3100; cardiovascular disease 600; and ophthalmology 140. Pharma companies typically reinvest around 20% of sales revenue in R&D for new products, whereas in contraception this figure is around 2%.

One of the largest investors is a philanthropic organization – the Bill & Melinda Gates Foundation. Relying on philanthropy to this extent is unusual for medical products with strong markets in high income countries, but it is common in contraception. Most of the contraceptive methods available today were developed with substantial public and philanthropic dollars (including the first implant, the copper and hormonal IUDs, hormonal IUD, and the levonorgestrel and ulipristal acetate ECPs) [10]. Academic institutions, along with non-profit product development partners (such as Population Council, FHI 360, CONRAD, PATH, and others), lead much of the basic science, preclinical work, and clinical trials, for contraceptives with the private sector entering R&D at much later stages than in other therapeutic areas.

One sector that could change this historic pattern is biotech. A number of small companies have innovative contraceptives in early R&D, which could attract much needed additional private sector funding to the field. Overall, however, the level of funding in the field needs to increase by an order of magnitude if we ever expect to see a robust new set of contraceptive options.

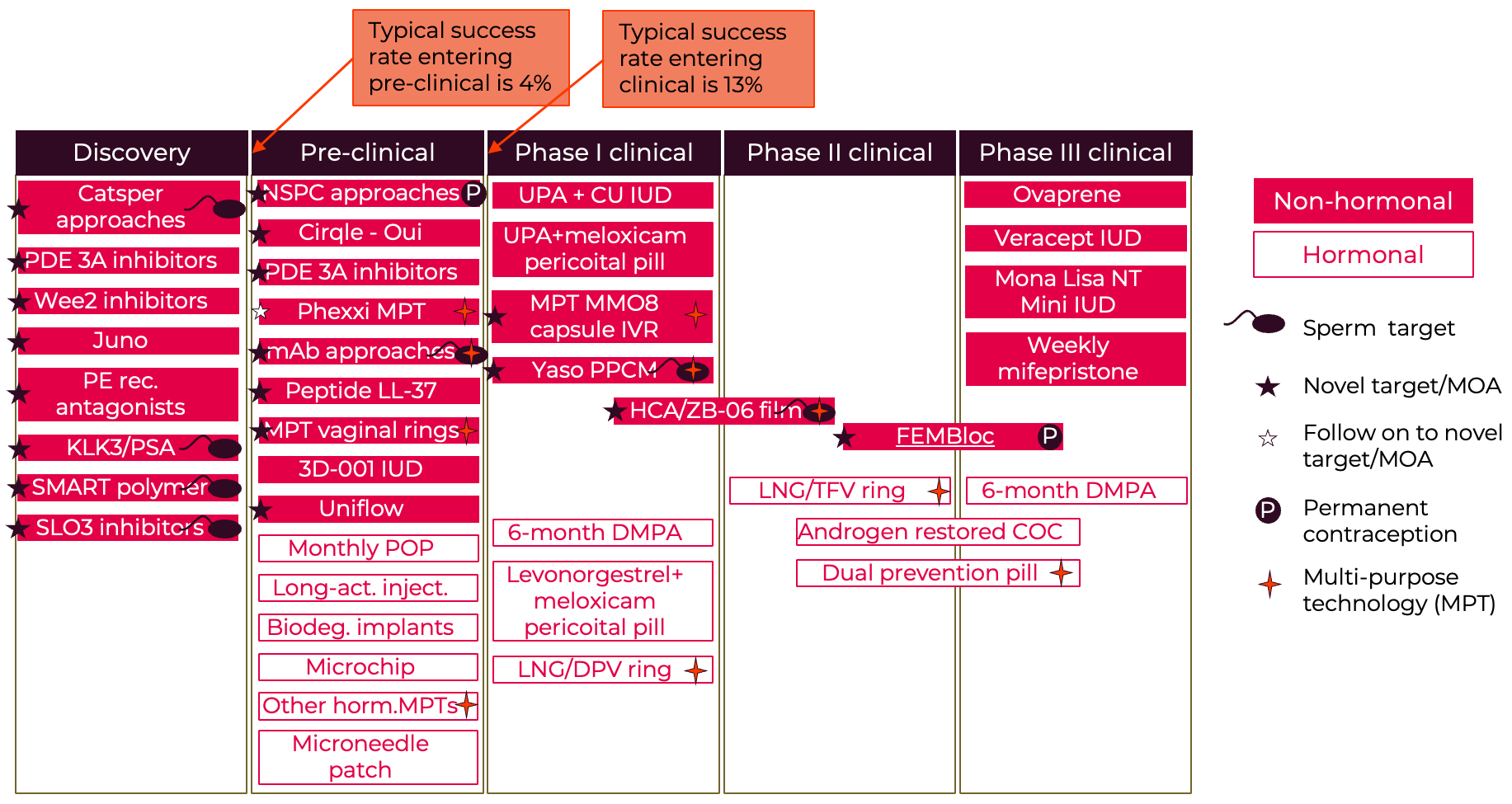

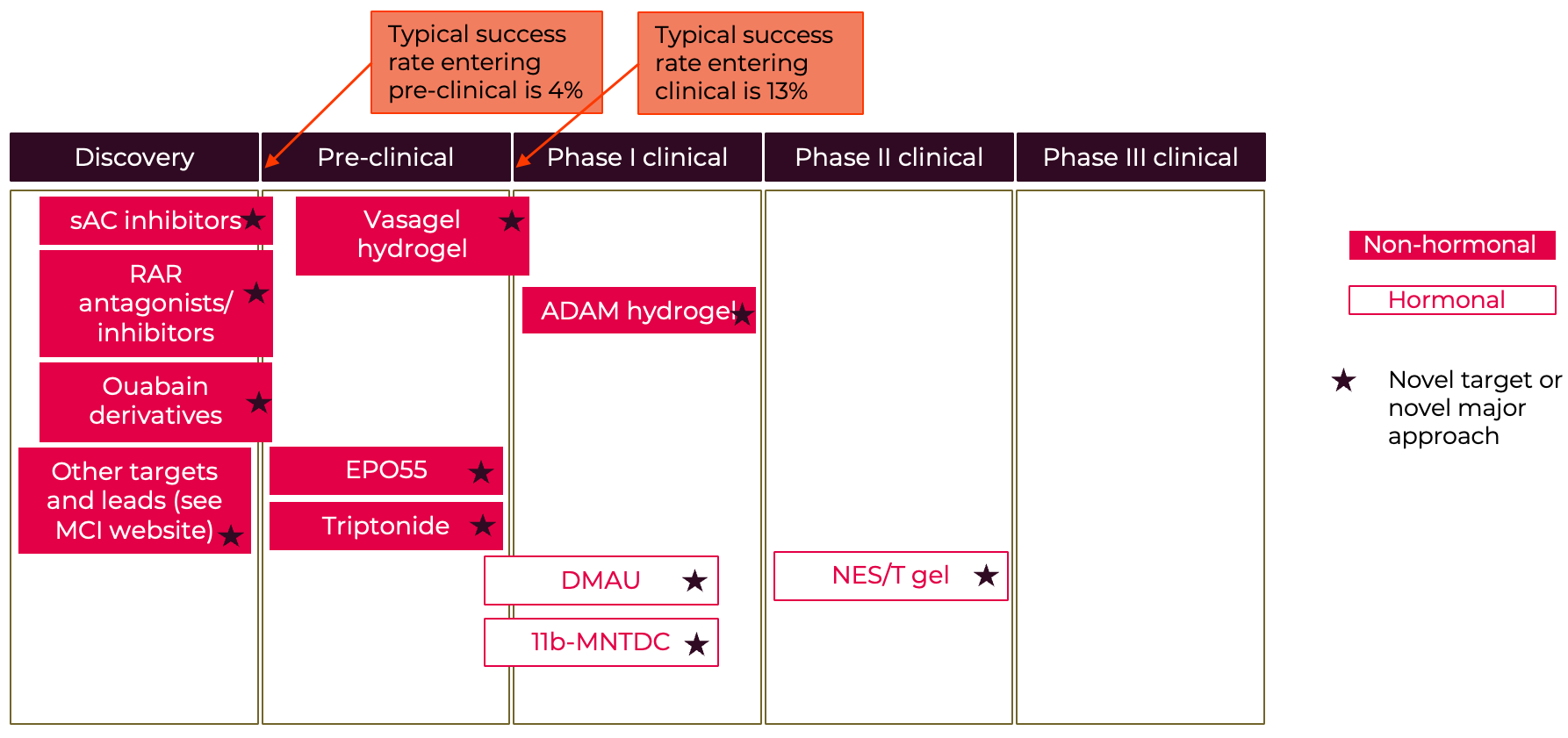

The current contraceptive pipeline

A selection of the latest leads and new potential products are illustrated in the two “pipeline” diagrams. One thing to note is that although we have very few male methods already on the market, the male pipeline shows the strong increase in male- and sperm-directed science. These potential new male methods are an exciting development. Although the female pipeline looks at first glance to be quite full, in fact many of these products are not progressing and there are very few based on novel female targets. Most of the pipeline options are iterations on existing mechanisms. Basically $134 million isn’t sufficient to generate enough new options, especially given the high expected failure rate through the R&D process. Analysis of the Calliope database at the Contraceptive Technology Exchange indicates that many of those already in R&D haven’t been progressing likely because of inadequate funding. It will be essential to invest in early-stage biology to uncover more potential opportunities. Meanwhile perhaps the strongest set of novel options may come from sperm-directed innovation which also offers the potential for female-controlled options.

Figure A5: Female Contraceptive R&D Pipeline

Selected examples

Figure A6: Male Contraceptive R&D Pipeline

Selected examples

For more details – see NewGen White Paper

For more information on the male pipeline see the Male contraception initiative website - https://www.malecontraceptive.org/

For a recent discussion on the latest contraceptive research and the need for innovation in the contraceptive pipeline see this article - https://pubmed.ncbi.nlm.nih.gov/36780138/

Stay Connected with Us!

Join our newsletter list to receive the latest updates on our project and goals